The Estate Planning Attorney Ideas

Table of ContentsNot known Incorrect Statements About Estate Planning Attorney The Ultimate Guide To Estate Planning AttorneyEstate Planning Attorney - An OverviewExcitement About Estate Planning Attorney

Your attorney will additionally aid you make your documents authorities, scheduling witnesses and notary public signatures as required, so you don't have to bother with trying to do that last step on your very own - Estate Planning Attorney. Last, yet not the very least, there is useful satisfaction in developing a partnership with an estate preparation attorney who can be there for you later onPut simply, estate preparation attorneys offer worth in many means, much beyond just offering you with published wills, depends on, or various other estate preparing documents. If you have inquiries about the procedure and intend to discover more, contact our workplace today.

An estate planning lawyer helps you define end-of-life decisions and legal papers. They can establish wills, develop counts on, develop health care regulations, establish power of lawyer, develop succession strategies, and much more, according to your dreams. Dealing with an estate preparation attorney to finish and oversee this legal documentation can assist you in the following 8 locations: Estate preparing lawyers are experts in your state's depend on, probate, and tax regulations.

If you don't have a will, the state can make a decision how to split your properties among your successors, which may not be according to your dreams. An estate preparation attorney can assist arrange all your lawful papers and disperse your assets as you want, possibly avoiding probate. Many individuals prepare estate planning papers and after that ignore them.

Our Estate Planning Attorney Diaries

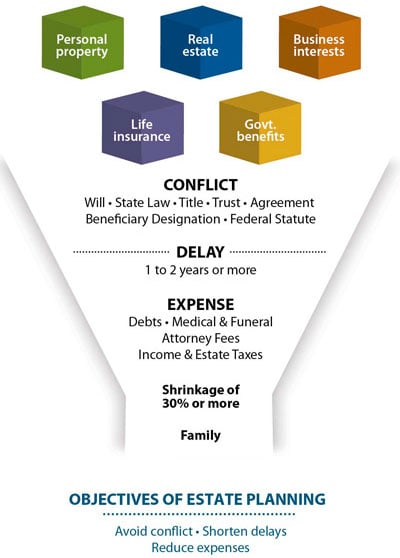

When a client passes away, an estate plan would determine the dispersal of properties per the deceased's instructions. Estate Planning Attorney. Without an estate plan, these decisions might be entrusted to the near relative or the state. Obligations of estate coordinators include: Creating a last will and testimony Establishing trust fund accounts Naming an executor and power of lawyers Recognizing all beneficiaries Naming a guardian for small kids Paying all financial obligations and lessening all taxes and lawful fees Crafting instructions for passing your worths Establishing preferences for funeral setups Settling instructions for care if you become unwell and are not able to make decisions Getting life insurance policy, special needs earnings insurance coverage, and long-term treatment insurance An excellent estate plan need to be upgraded consistently as clients' financial circumstances, personal inspirations, and federal and state legislations all advance

Just like any career, there are qualities and abilities that can help you attain these goals as you collaborate with your customers in an estate coordinator duty. An estate planning occupation can be right for you if you have the following characteristics: Being an estate organizer implies assuming in the long-term.

Estate Planning Attorney Can Be Fun For Everyone

You should help your customer anticipate his/her end of life and what will happen postmortem, while more helpful hints at the same time not dwelling on somber ideas or emotions. Some clients might become bitter or distraught when contemplating fatality and it might be up to you to aid them via it.

In the occasion of death, you may be anticipated to have many conversations and transactions with surviving household participants regarding the estate plan. In order to succeed as an estate coordinator, you may require to walk a great line of being a shoulder to lean on and the private depended on to communicate estate preparation matters in a prompt and expert manner.

tax code transformed thousands of times in the one decade in between 2001 and 2012. Expect that it has actually been modified further ever since. Depending upon your customer's financial earnings brace, which might evolve toward end-of-life, you as an estate coordinator will have to maintain your customer's properties completely legal compliance with any kind of neighborhood, government, or worldwide tax obligation regulations.

Some Known Details About Estate Planning Attorney

Acquiring this qualification from organizations like the National Institute of Licensed Estate Planners, Inc. can be a strong differentiator. Belonging to these specialist this hyperlink groups can validate your abilities, making you a lot more appealing in the eyes of a possible customer. In enhancement to the emotional incentive of assisting clients with end-of-life preparation, estate coordinators delight in the advantages of a stable earnings.

Estate preparation is an intelligent point to do no matter your existing health and wellness and financial condition. Nonetheless, not so many individuals understand where to begin the process. The first vital thing is to work with an estate planning lawyer to help you with it. The adhering to are 5 advantages of working with an estate preparation attorney.

A knowledgeable attorney knows what information to include in the will, including your recipients and special considerations. It likewise supplies the swiftest and most reliable approach to transfer your possessions to your beneficiaries.